Basic Concepts

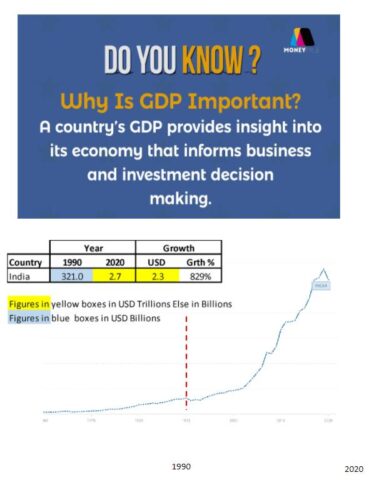

Why is GDP important?

- Gross Domestic Product is very important as it gives information about the size and progression of a nation’s economy.

- It is more like an indicator of the general health of the economy. So an increase in GDP, means that the economy is healthy, and vice versa

- With this data, governments can determine if action is needed to fix the economy and also know what sectors require improvement to increase their GDP in the future

What is Gross Domestic Product?

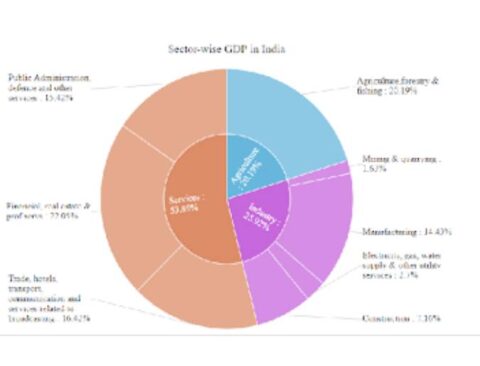

- Gross Domestic Product (GDP) is a tool that measures the market value of goods and services produced by a country measured over a certain period of time (normally annually)

- GDP is composed of goods and services produced for sale in the market, and also non – market production such as defence, education, etc provided by the government.

- It counts the output (money produced by the country) generated by a country

How does GDP help you create wealth?

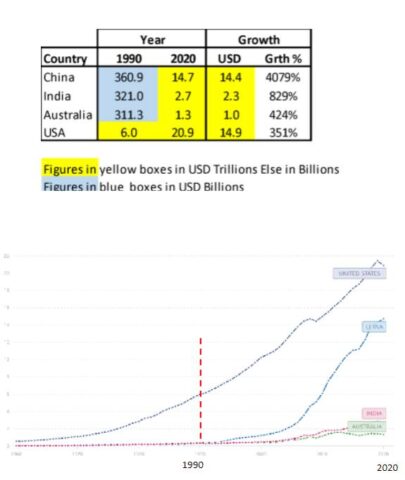

- If you are looking to invest your money, you should start reading thoroughly about which countries are projected to have the highest growth rate.

- GDP is composed of goods and services produced for sale in the market, and also non – market production such as defence, education, etc provided by the government.

- Also do take into consideration of not putting your money into a developing country that has no industries and hence no value addition. It is thus unlikely that their GDP will increase significantly.

- You should invest your money into a country that has a medium GDP and that is projected to rise exponentially in the future

What are the 3 pillars of income?

- The 3 pillars of income are –

Active Income: is money you work for. You earn active income when you show up for work and trade our time and energy for money

Passive Income: is income that requires very little or no effort at all. If you own a house for example, and your tenants pay monthly rent; you are making passive income where money works for you. Increase in share price and Royalties on books written are other good examplesInterest Income: the cost of using someone’s money. For example if you put your money in a bank account; they will pay you a certain % of interest

What are assets and liabilities?

- If you are looking to invest your money, you should start reading thoroughly about which countries are projected to have the highest growth rate.

- The secrets on your wealth building process is increasing your assets which in turn earn for you, while simultaneously and decreasing your liabilities:

- – Assets: a resource that earn passive income (gold, shares in companies, land plots, etc)

- – Lability: a resource that drains out money (expensive cars, lavish lifestyle habits such as eating out often, and spending on expensive clothes and travel beyond ones means, taking on debt, taxes, etc)

What is compound interest?

- Compound interest is the interest on a loan or deposit amount

- It is calculated based on the addition of interest to the principal sum, or in other words, interest on interest.

- It is the result of reinvesting interest, rather than paying it out, so that interest in the next period is then earned on the principal sum plus previously accumulated interest

- Compound interest causes your wealth to grow faster.

- The magic of compounding can be an important factor when building your wealth.

Rule of 72 :

By dividing 72 by the annual rate of return,

72/8 = 9 years (Fixed deposit rate)

72/24 = 3 years (Good equity share)

Compounded Annual Sum = Principal (1 + Rate of return) number of years

What is Risk?

- Risk is the chance of failure that is going happen

- It involves the uncertainty about the consequences of an action

- In terms of finance, it is the chance that an outcome or investment’s gain will differ from an expected outcome

- It also includes the possibility of losing some or all of an investment

What is a Risk Asset?

- A risk asset is any asset that carries a degree of risk.

- It normally refers to assets that have a significant degree of price fluctuations

- Examples such as equities,corporate bonds, crypto – currency,, etc

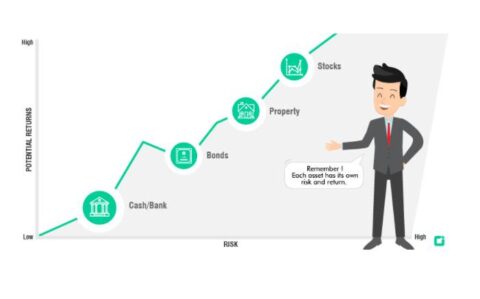

Types of Risk Assets

- There are 2 main types or Risk Assets – 4

- Low Risk: assets that have a low or virtually no possibility of loss of value,

- if yes by very little, because of this interest rates or returns are very low as investors

- a few low risk assets are gold, real estate, government bonds, etc

- High Risk: assets that have a higher chance of loss hence these assets attract higher rates of return

- Examples of high risk assets are equities, crypto – currency, corporate bonds, etc

Is it safe to invest in risk assets?

- Before investing in any kind of asset, you should always read about it before you invest to know how to invest probably, know what to do during a loss, etc

- Many assets also take time to appreciate in value, patience is required for your wealth to grow

- Property is the only asset that can be insured against destruction of the same.

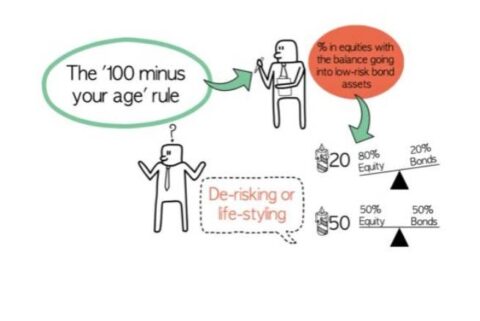

How do I know how much money to put in low or high risk investments?

- The Rule of 100 determines the percentage of your money that will be put into these two investment groups

- 100 – your age out of 100 (the result goes into high risk, while the reminder in low – risk): for example if you are 20, 100 – 20 = 80%.

- So 80% of your money should go into high – risk investments, and the remaining 20% in low – risk. The reverse would be true if you are 80

- The average age of retirement is around 60 years, and hence putting most money into high – risk investments and in the event of a bear cycle you end up losing it

- In summary, as you get older; you should have more money in low – risk investments, and vice versa