Mutual Fund

What is a mutual fund?

- A mutual fund is a pool of money collected from many investors for investments in various assets such as bonds, equities, gold, etc

- Mutual Funds are operated by money manager who manages the investor’s money and allocates it to various assets to grow it from the principle amount (initial amount of money)

- It gives investors access to a professionally managed pool of a variety of assets which when invested in, can either increase or decrease

Types of Mutual Funds

- There are 2 main types of mutual funds:

- Equity Fund: a mutual fund that mostly invests in equities, but other assets too such as bonds, real estate, gold, etc. They are also referred to as stock funds

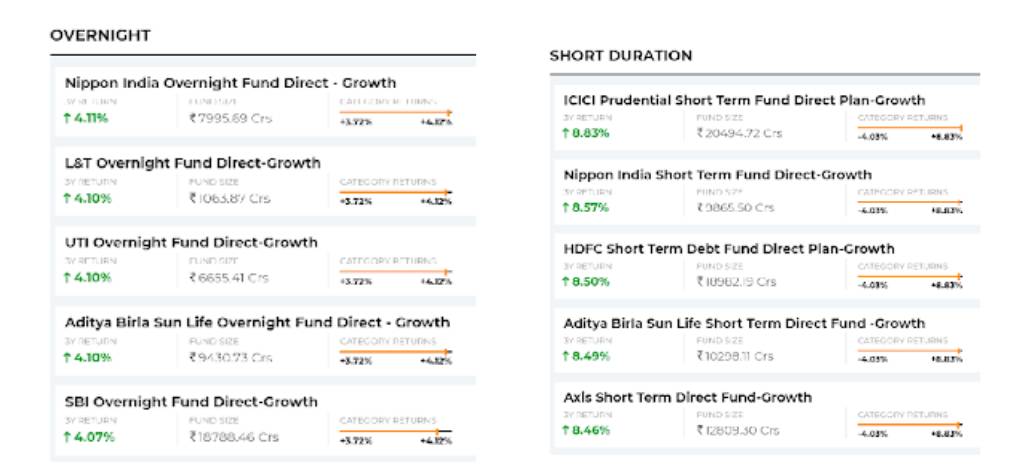

- Debt Fund: a mutual fund where money is invested in fixed income securities that is issued by a government, corporation, or any other entity to finance their operations. Examples of debt funds are government bonds and corporate bonds

Pros and Cons of Mutual Funds

PROS

|

CONS

|

Is it safe to invest in mutual funds

- Mutual Funds are safe to invest if you understand them; choose the right fund manager, amount of money to invest, etc

- This asset is extensively regulated by bodies to prevent managers and corporations from stealing your money

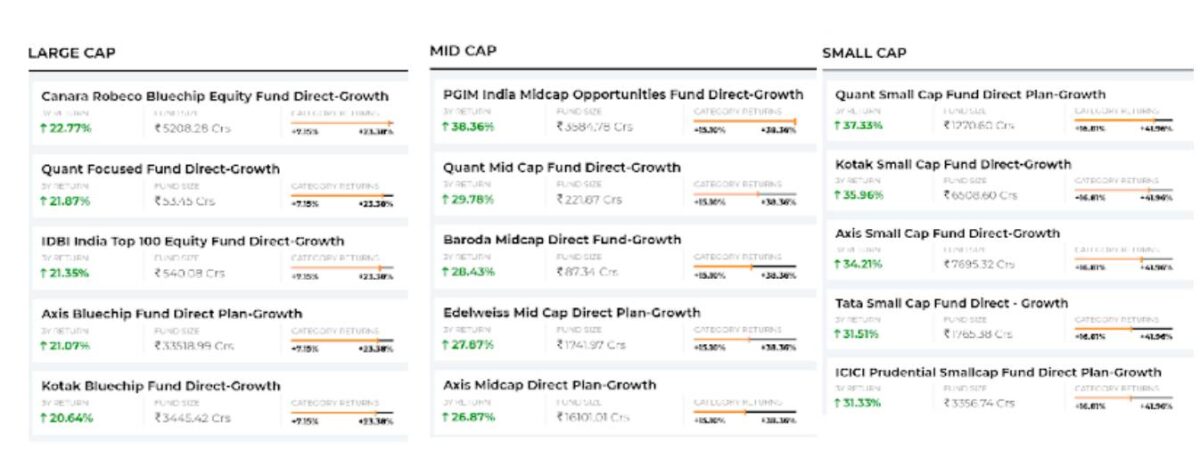

Top Equity funds in India Dec 2021

Top Equity funds in India Dec 2021

Summary

- Carefully read about Mutual Funds; for example what they are, type of risk, choosing a fund manager, etc

- Monitor your mutual fund on a monthly basis

- Always make your mutual funds payment (for example mutual fund manager fee, mutual fund fee, etc) early to avoid a lateness penalty, which will just increase your fee

- Make sure to reinvest any money into the mutual fund that you receive to increase your investment; such as dividends or increase